United Kingdom & Ireland

Version 1.4 / 31.08.2021

Integrity, Legal, and

Tax Compliance Checks

Amount Differences

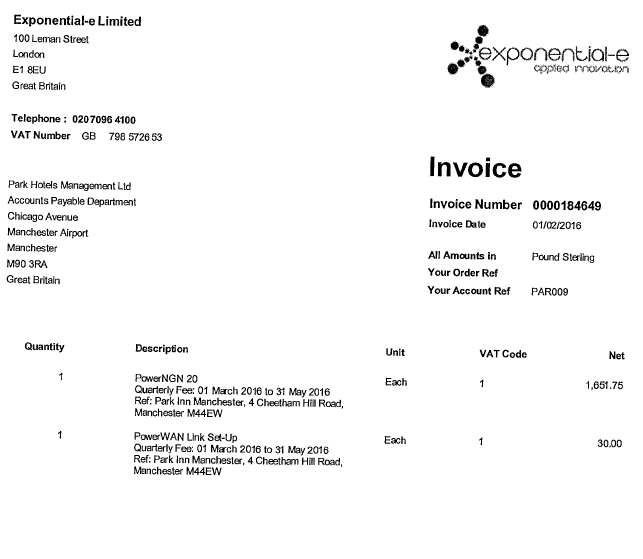

Invoice Number

Invoice Date

Supplier Address

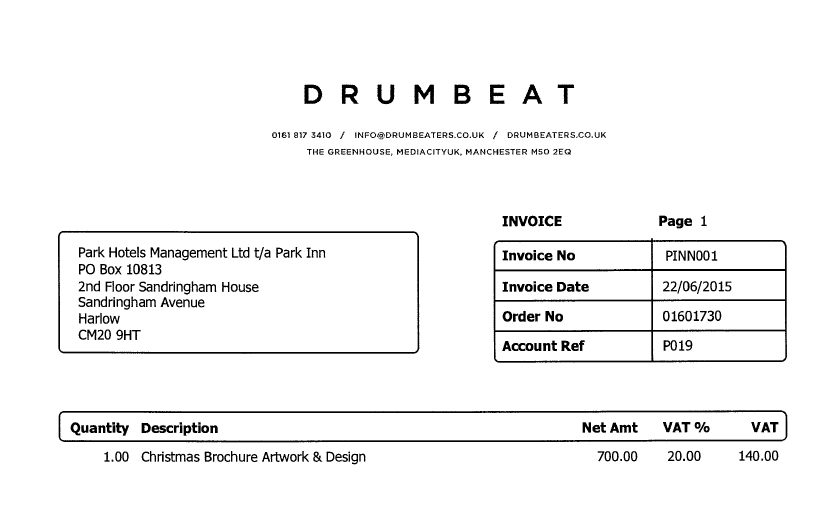

Customer Address

Tax ID

General Capturing Instructions

Payments on Invoices

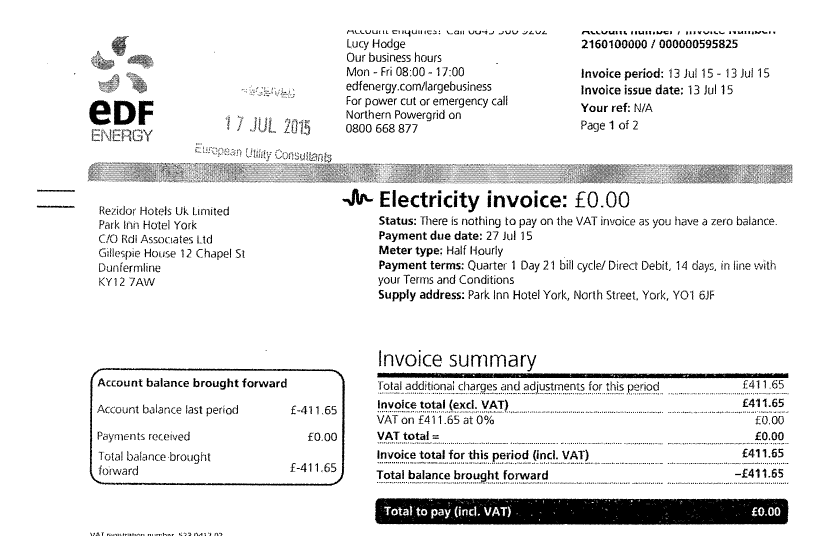

Balance Brought Forward

Invoice Address Deviates from Delivery Address

VAT Capturing

Document Upload

Standard Procedure

Documents – to check

Provisions of Invoices

Provided by Exela

Paper Invoices

E-Mail

EDI – e-invoice

In order to streamline the capturing process the following rules for uploading invoices have to be applied.

If a compliance or integrity check fails then the related invoice or credit note has to be returned by Exela with a request to provide an amended one.

Rejected invoices can be selected in the archive of SIMS by searching by the status “rejected”. The return letter to the supplier with the reason for the rejection is visible at the Attachments tab.

A difference of GBP 0.20 between the sum of the line items and the sub total of an invoice will be accepted.

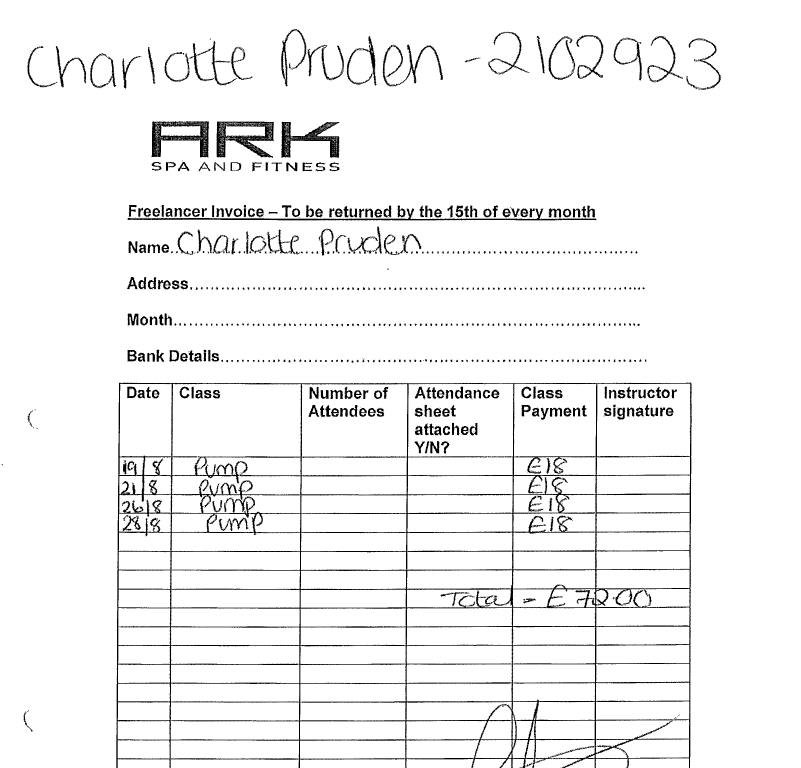

Each invoice must provide an invoice number. Invoices without VAT can be accepted without an invoice number.

Example

for a rejection:

Example

for a rejection:

An invoice date has always to be stated. If none is provided the invoice has to be rejected.

A complete supplier address has to be stated on the invoice.

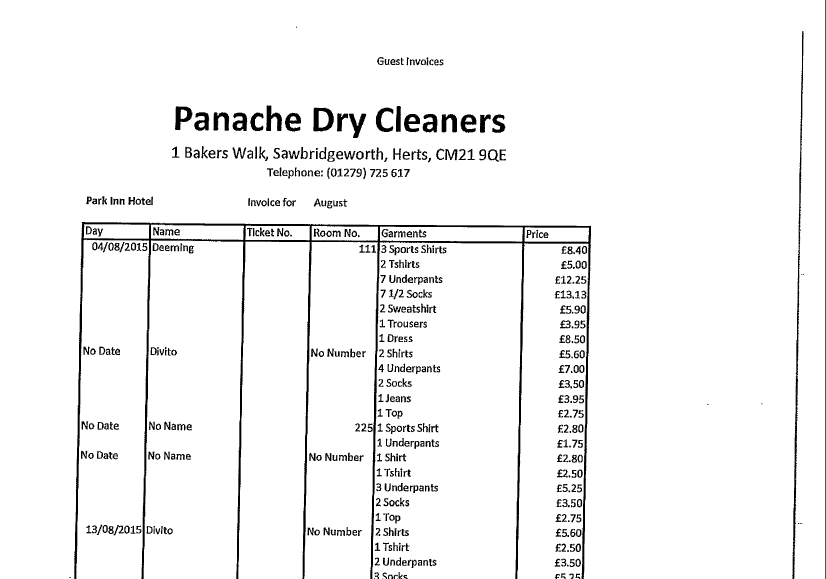

Example where no complete supplier address is stated:

Example with no supplier address:

In this example, there are no supplier details at all, so

Exela cannot

contact the supplier directly. In this case, the invoice would be sent to

the hotel so that the hotel can identify the supplier and notify Exela who

the supplier is. Exela will then reject this invoice and communicate with

the supplier in the normal way.

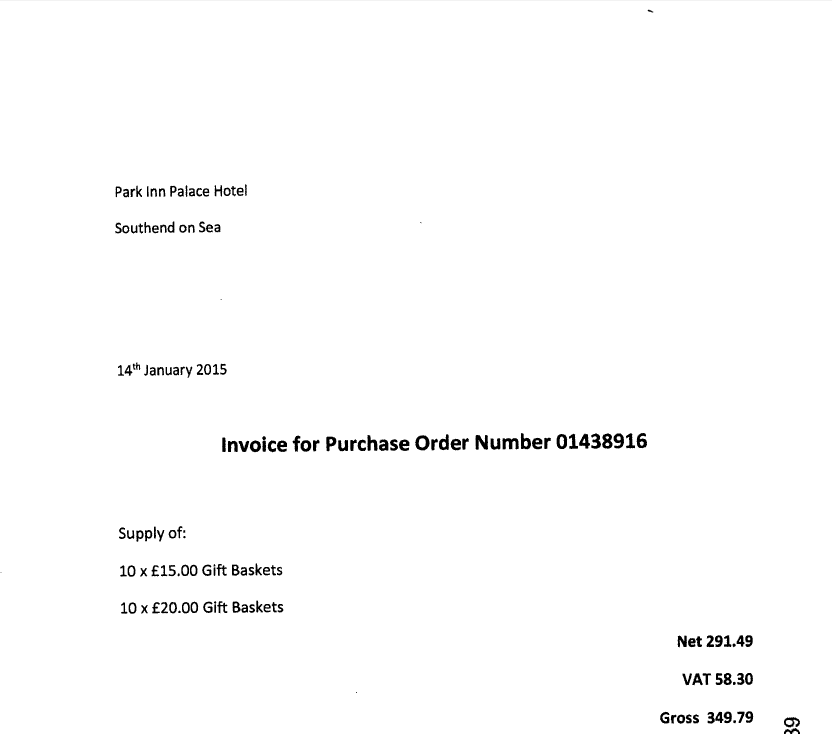

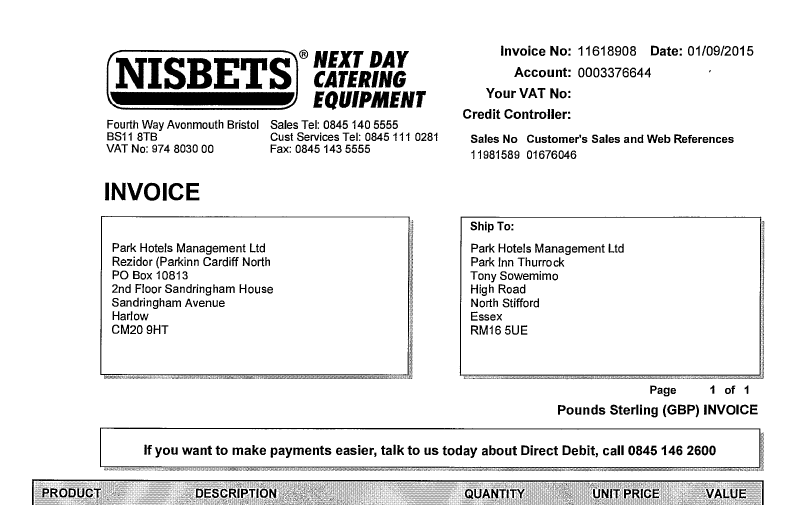

The hotel address or the one of the legal entity has to be provided on the invoice. Invoices where the delivery address is deviating from the invoice address will be returned to the supplier with the request of an amendment.

Example

with an incomplete address:

Example where no recipient is mentioned on the invoice:

All two sample invoices would be rejected and returned to the supplier with

a request of an amendment.

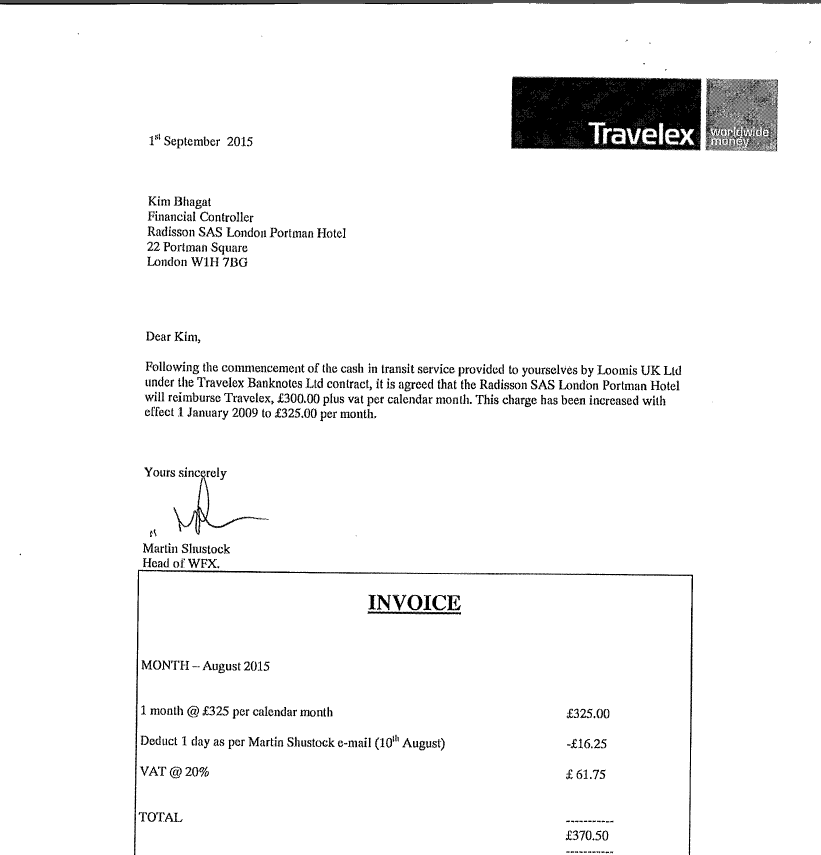

Invoices which are containing VAT must provide a VAT registration number. In addition, the VAT percentage and value must be indicated separately for each percentage. Where VAT is not applicable, a reference to the article of law governing the exemption must be provided.

Invoices without this information have to be returned.

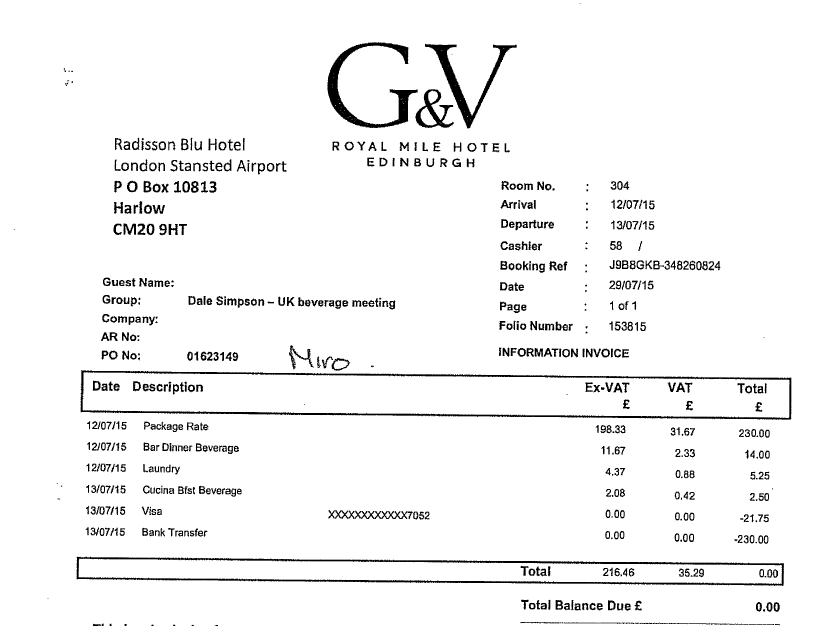

Advance payments on invoices are not captured. The majority of these cases refer to hotel invoices.

Requests from hotels for adding this information will be forwarded to BDO. When approving the invoice the hotel should notify BDO by e-mail that a payment has already been made against the invoice and provide the details of how that payment was made. BDO will then post the advance payment against the invoice and then pay the balance.

Example:

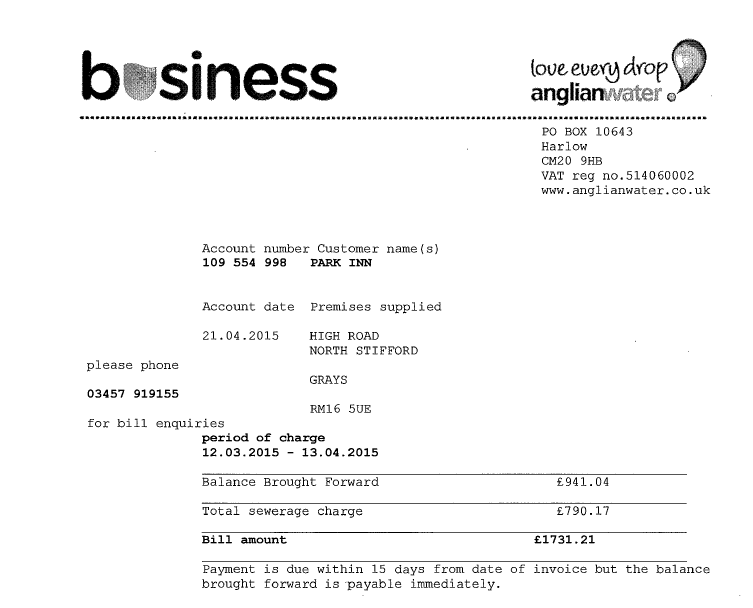

Balance brought forward amounts are not captured. Only the content of the shown invoices will be recorded.

Requests for capturing these amounts will be forwarded to BDO. This is often the case if there was an overpayment on previous invoices.

Example:

Example:

In this instance the invoice can only be allocated by Exela to the hotel that the invoice is addressed to which in this case is the Park Inn Cardiff North. If the invoice should not have been addressed to the Park Inn Cardiff North then that hotel should place the invoice on Hold on Exela and then contact the supplier asking for a credit note to be raised.

All invoices are captured with VAT, including foreign invoices. In cases, where the VAT is not applicable, such as often with foreign invoices, these are to be posted with the posting case "Gross". When posted in the "Standard" posting case with a foreign VAT percentage, SIMS will typically show the error message "Tax Key Not Available".

During the upload process of documents a number of additional integrity checks are taking place. Depending on the type of the document and the result of the check it will be released to the flow or routed in one of the query inboxes.

The standard routing of a document if it isn’t flagged by one of the checks described in Documents – "to check" is the following:

|

Document type |

Comment |

Query inbox |

|

Statement |

|

A |

|

Reminder |

|

A |

|

Letter |

|

C |

|

Other |

|

C |

|

|

|

|

|

All |

Missing Creditor |

A |

|

All |

Problem to check |

B |

|

All |

RESCAN |

P |

|

Invoices |

Total Value Zero |

A |

Caption:

A – Query to Accounting

B – Query to BancTec

C – Query to Controlling

P – Query to Post Office

For the upload of an Invoice/Credit Note the hierarchical rule is applied as follows:

First approval instance – supplier master data

If a first approval instance is stored at the supplier master data record

the invoice is routed into the “Approval Inbox” of the mentioned department.

Cost centre definition

Per property each cost centre is assigned to a department (role). The

document will be automatically routed to the department inbox based on the

cost centre which is stored at the supplier master data record if no first

approval instance is defined. The cost centre information at the supplier is

provided by BDO. This data is updated once a day in the morning. Changes can

be provided by BDO only.

If one or multiple checks are failed during the upload of a document this is automatically routed to one of the query inboxes. Then the document gets the status “to check”, a QA comment and reason will be added.

|

Document type |

Comment |

Query inbox |

|

Invoice/ |

Document- and supplier number is identical |

B |

|

|

Identical document number independent from the supplier ID |

B |

|

|

Same supplier ID, amount and document date |

B |

|

Document type |

Comment |

Query inbox |

|

Invoice/ |

The supplier master data record is flagged for an additional QA check |

B |

|

|

Total value of the document is zero |

C |

|

|

Document currency deviates from the default one of the supplier master

data record |

B |

|

|

Last day of the current month +1 month <= document date <= 01.01.2012 |

P |

|

|

Supplier is flagged as foreign one (Tax flag = 1) and VAT is captured as

deductible for the document |

B |

Caption:

A – Query to Accounting

B – Query to BancTec

C – Query to Controlling

P – Query to Post Office

Paper invoices should be sent directly by the supplier to the PO Box. Therefore, these instructions have to be added on the template of the order form

sent to the supplier. Invoices received on property have to be sent by the hotel

to the BPO scanning centre of Exela in Harlow. Scanned paper invoices provided

by email from the hotels are not accepted due to quality and

processing issues.

[Hotel name or name of the legal entity]

PO Box 10 813

Harlow

CM 209 HT

Suppliers can provide invoices directly to the Exela BPO Centre as an attachment. The permitted format for all documents is PDF only. Other formats can cause problems at the upload and capturing process due to missing references, macros, malware, etc. Therefore the following provisions shall be taken into account which should be added on the template of the order form:

All invoices must be sent by the invoice issuer directly to the

respective property invoice e-mail address:

gb.invoice@radissonhotels.com

E-invoices are invoices in a structured electronic format to be uploaded directly into the system without any manual capturing.

Invoice copies for those suppliers providing e-invoices should not be sent to the Postoffice for uploading. These copies will be strictly ignored by the Postoffice to avoid duplicates. For a list of e-invoice suppliers, please refer to the Organisational Manual.

If you miss invoices from one of the e-invoicing suppliers please address this to the support team (support@uk.rezdms.com) because this has typically technical issues we have to get notice in order to address this at the EDI Team of the supplier. It is their obligation to provide all invoices electronically.